Interpretation: The Purchasing Manager Index Of The Manufacturing Industry Continued To Stay In The Expansion Range In August

On August 31, 2021, the service industry survey center of the National Bureau of statistics and the China Federation of logistics and purchasing released the China purchasing manager index. In this regard, the National Bureau of Statistics Service Industry Survey Center Senior Statistician Zhao Qinghe has carried on the interpretation.

Affected by the recent domestic epidemic and flood situation and other factors, the purchasing manager index of the manufacturing industry in August was 50.1%, down 0.3% from the previous month, and remained in the expansion range; The business activity index of non manufacturing industry was 47.5%, lower than 5.8 percentage points of the previous month, falling below the critical point. Among them, the construction industry was 60.5%, higher than 3.0 percentage points of the previous month, which was in the high prosperity range. The service industry was 45.2%, significantly lower than 7.3 percentage points of the previous month; The composite PMI output index was 48.9%, 3.5 percentage points lower than the previous month.

1、 The purchasing manager index of manufacturing remained in the expansion range

In August, the expansion of the manufacturing industry weakened, and the business situation narrowed. Among the 21 industries surveyed, PMI of 10 industries is in the boom zone, 3 less than that of last month. Main features of the month:

First, the overall stability of production activities. The production index was 50.9%, down 0.1% from the previous month. The fluctuation of the index was small, and the production of the manufacturing industry maintained a stable expansion. In terms of the industry situation, the production index of agricultural and sideline food processing, paper printing, cultural, educational, sports, sports, entertainment products, railway, ship, aerospace equipment and other industries were all in a relatively high boom range above 55.0%, and the production growth was accelerated; The production index of petroleum, coal and other fuel processing, ferrous metal smelting and rolling processing, automobile and other industries was lower than the critical point, and the production decreased month on month.

Second, market demand has weakened. The index of new orders was 49.6%, lower than 1.3 percentage points of the previous month, falling below the critical point. This month, the index of new orders of high energy consuming industries has fallen significantly, which has a significant negative impact on the manufacturing industry. Among them, the index of new orders of petroleum, coal and other fuel processing, chemical fiber, rubber and plastic products and other industries has been below the critical point for three consecutive months, reflecting the continuous decline of market demand. In addition, some enterprises reported that affected by the epidemic situation and flood situation, raw material supply and product delivery were not smooth, the production cycle was prolonged, and new orders were reduced. At the same time, the market demand of some industries increased steadily this month. The index of new orders of food, wine and beverage refined tea, medicine, special equipment and other industries was in the expansion range, and higher than the level of last month and the same period last year.

Third, the price index has both declined. The purchasing price index and ex factory price index of main raw materials were 61.3% and 53.4%, respectively, lower than 1.6% and 0.4% of the previous month, and the difference between the two price indexes narrowed for three consecutive months, from 12.2% in May to 7.9%. From the purchasing price index of main raw materials, the 21 industries surveyed are all higher than the critical point. Among them, the indexes of petroleum coal and other fuel processing, ferrous metal smelting and calendering processing industries have dropped significantly, but the textile, chemical raw materials and chemical products, non-metallic mineral products and other industries are still higher than 65.0%, and the purchasing cost pressure of relevant enterprises is still large. From the perspective of ex factory price index, oil, coal and other fuel processing, chemical fiber, rubber and plastic products and other industries fell by 12.0 percentage points or more, falling below the critical point for the first time since May.

Fourth, the PMI of large and medium-sized enterprises is located in the expansion range. The PMI of large and medium-sized enterprises were 50.3% and 51.2% respectively, falling and rising compared with the previous month, and both were at or above the critical point for six consecutive months, indicating that the operation situation of large and medium-sized enterprises is relatively stable. The PMI of small enterprises was 48.2%, which was lower than the critical point for four consecutive months, which indicated that the prosperity level of small enterprises continued to be low and the pressure of production and operation was high.

Fifth, enterprises have stable confidence in market development. The expected index of production and operation activities was 57.5%, which continued to be in the high boom range. Among the 21 industries surveyed, except textile industry and ferrous metal smelting and rolling processing industry, other industries were higher than the critical point. Some enterprises in the survey reported that with the gradual fading of the impact of the epidemic and flood situation, production and operation will soon return to normal, and the enterprises are still optimistic about the future development.

2、 Non manufacturing business activity index fell significantly

In August, the non manufacturing business activity index was 47.5%, lower than 5.8 percentage points of the previous month, which was the first time since March 2020 to fall below the critical point.

The construction industry rose to a high level. This month, the construction industry's production activities accelerated, and the business activity index was 60.5%, 3.0 percentage points higher than that of the previous month, returning to the high boom range. Among them, the business activity index of civil engineering construction industry was 60.8%, a sharp increase of 6.4 percentage points compared with the previous month. From the perspective of market demand and employment situation, the index of new orders and the index of employees are in the expansion range, indicating that the number of new contracts signed and the employment of enterprises in the construction industry has increased.

The prosperity level of the service industry has dropped by a large margin. The multi provincial and multi-point epidemic has brought great impact on the service industry which is still in the recovery process. The business activity index of the service industry was 45.2%, lower than 7.3% of the previous month, and dropped below the critical point for the first time in this year. From the perspective of industry situation, the epidemic situation inhibited the release of the demand of contact aggregation service industry, the business activity index of road transportation, air transportation, accommodation, catering, leasing and business services, ecological protection and environmental management, culture, sports and entertainment industries dropped below the critical point, and the total business volume decreased significantly; At the same time, wholesale, postal, telecommunications, radio and television and satellite transmission services, monetary and financial services, capital market services and other industries were all higher than 54.0%, and the total business volume continued to grow. From the perspective of market expectation, the expected index of business activities is 57.3%, which is in a relatively high boom range, indicating that with the effective control of this round of epidemic situation and the approaching of Mid Autumn Festival and National Day holidays, enterprises are more optimistic about the recovery of service industry market in the near future.

3、 The composite PMI output index fell below the critical point

In August, the comprehensive PMI output index was 48.9%, lower than 3.5% of the previous month, indicating that the production and operation activities of Chinese enterprises slowed down significantly compared with the previous month. The manufacturing production index and non manufacturing business activity index, which constitute the composite PMI output index, are 50.9% and 47.5% respectively.

(source: National Bureau of Statistics)

- Related reading

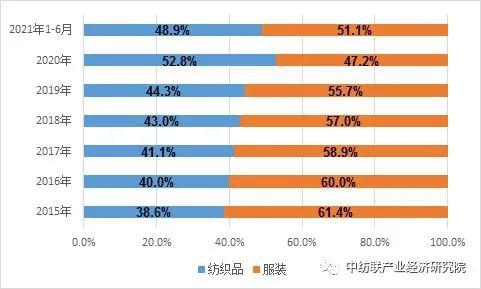

In The First Half Of The Year, China'S Textile And Garment Exports Set A Record For The Same Period

|

Data Analysis: The Operation Of China'S Clothing Industry In The First Half Of 2021 And Its Development Forecast In The Second Half Of 2021

|- Shoe Express | "The Right Shoemaker'S Heart" 2021 New Five Stages Start!

- Recommended topics | Walking With Love, Red Bean Shares "Looking For The Most Beautiful Love Story" Resonates

- News Republic | Finelycup Fan You Kapo 2022 China International Fashion Week Redefines Rimless Underwear

- Professional market | "Core" Panic Shrouds Chengdu Auto Show: What To Do In The Second Half Of The Sprint "No Car To Sell"?

- Finance and economics topics | Net Profit Declines In The First Half Of 2021

- Industry stock market | Shanghai Sanmao (600689): In The First Half Of The Year, The Net Profit Attributable To The Parent Company Was 6.8357 Million Yuan, Turning Losses Into Profits

- Industry standard | Profiteering "Black Gold" And Damaged Middle And Lower Reaches: The Joys And Sorrows Of Photovoltaic Industry Chain Are Not Interlinked

- Finance and economics topics | *St Star Falling Back: Dark Finance And The Secret Of Toxic Assets Transfer

- Law lecture hall | Beijing Tongrentang Sued Tianjin Tongrentang For Infringing IPO, And Tianjin Tongrentang Claimed That Its Predecessor Could Be Traced Back To The Qing Dynasty

- Finance and economics topics | China'S First Provincial Capital Market Service Platform Unveiled

- China'S Purchasing Manager Index In August 2021 Is 50.1%

- President Li Lingshen And His Party Investigate Key Enterprises In Shandong

- Attention: Youngor Releases 2021 Semi Annual Report

- Small And Medium Sized Textile Enterprises In India Are Struggling

- Textile Machinery: "10 + 2" Provides Equipment Support For The Industry

- China Textile Federation Industrial Cluster Pilot Investigation Group Visited Liaoyang County

- Attention: Semiannual Report Of 2021

- "The Right Shoemaker'S Heart" 2021 New Five Stages Start!

- Walking With Love, Red Bean Shares "Looking For The Most Beautiful Love Story" Resonates

- Finelycup Fan You Kapo 2022 China International Fashion Week Redefines Rimless Underwear